IF YOU are choosing your next company car you need to know what company car tax banding it will be in, since this will determine the level of company car tax that you will pay.

This is known as benefit-in-kind, often shortened to BIK. Our company car tax tables can help you.

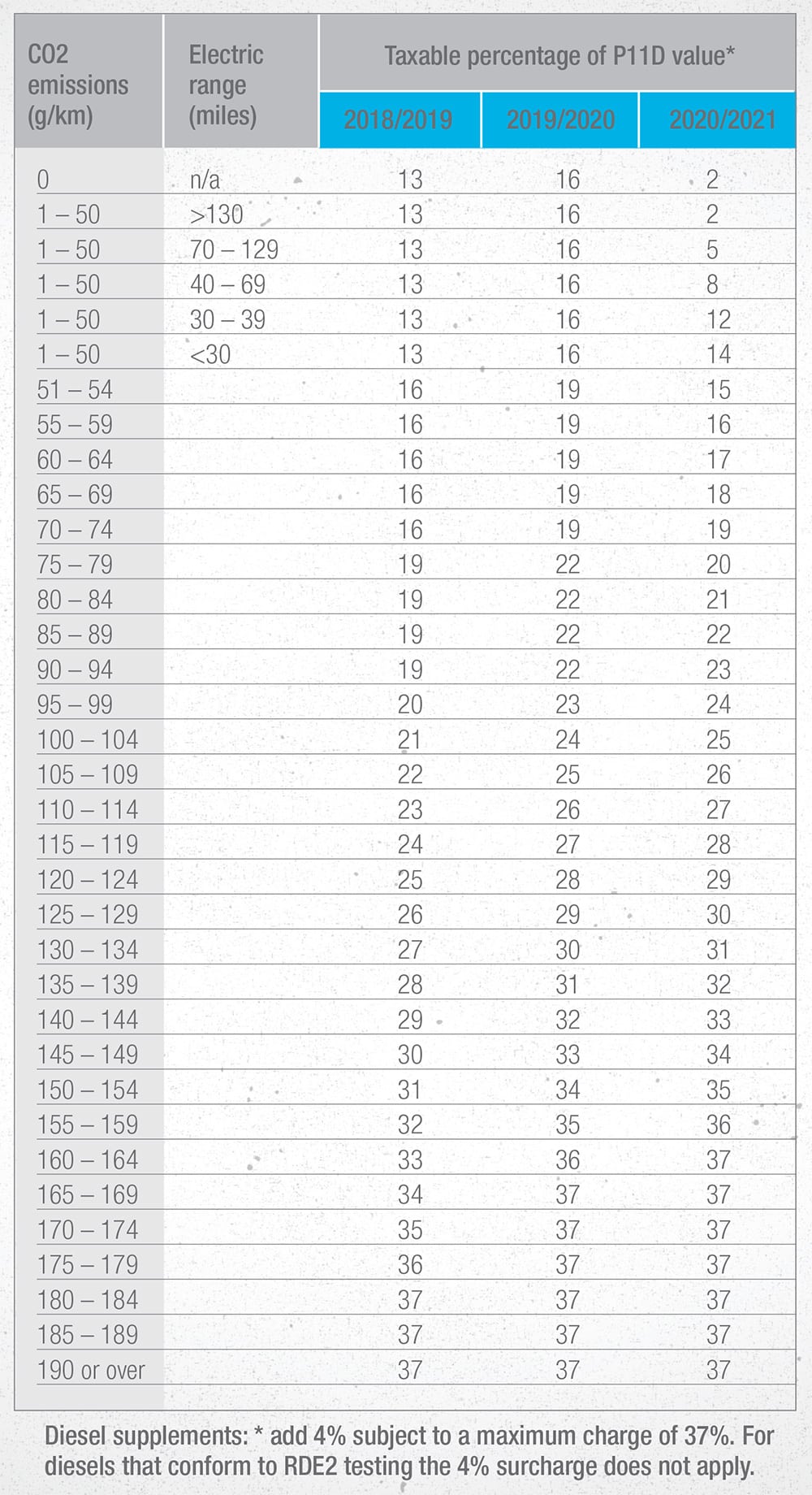

The company car tax table shows the CO2 emission bands on the left hand side columns. And the taxable percentage in the right hand side columns for each tax year.

The benefit in kind tax percentages will be applied to the P11D value of your company car for each taxation year.

Even though an electric car has zero emissions such cars are not exempt from company car tax. So our tax tables start at 0g/km CO2 emissions showing that an electric zero emission car will have a taxable rate of 13% in 2018/19, rising to 16% in 2019/20 before dropping down to 2% in 2020/21.

To use the company car tax table you need

- The CO2 emissions of your chosen company car

- The P11D value of your company car. This is the list price of the car including the cost of any options that you have added, as well as accessories over the value of £100 but excluding the first registration fee and vehicle excise duty.

- The type of fuel that your company car runs – because cars that run solely on diesel are subject to a 4% surcharge from April 07, 2018 announced by Chancellor Philip Hammond in the 2017 Autumn Budget. (Previously the diesel surcharge had been 3%.)

- Diesel cars that meet Real Driving Emissions Step 2 (RDE2) emission standards – a higher standard than Euro 6 – will be exempt from the diesel surcharge.

- Although RDE1 was introduced in September 2017, Driving Emissions, stage 2, isn’t due until at least 2020 which means that even if a diesel car meets the standard we won’t know because certification is not possible until 2020. And so until then every new diesel and every driver of a new diesel will be charged the additional 4% surcharge.

- The diesel surcharge does not apply to diesel hybrids.

To work out your company car tax

- Multiply the company car tax band percentage rate by your car’s P11D value to give you your benefit in kind

- Then multiply that figure by your marginal rate of tax: 20% or 40%.

- This will then give you your yearly amount of company car tax due.

- Should the CO2 emissions of your company car fall between CO2 bandings, simply round the number down to work out the company car tax band that applies.

- For example, a diesel company car with CO2 emissions of 98g/km would be subject to a 24% company car tax banding in the 2018/19 tax year.

Our company car tax tables are below – for your convenience, we have produced a downloadable pdf version as well as an online version. Simply click on the table below if you want to download the pdf.

Company car tax tables

Taxable percentage of P11D value *

| CO2 emissions (g/km) | Electric range (miles) | 2018/2019 | 2019/2020 | 2020/2021 |

| 0 | n/a | 13 | 16 | 2 |

| 1 – 50 | >130 | 13 | 16 | 2 |

| 1 – 50 | 70 – 129 | 13 | 16 | 5 |

| 1 – 50 | 40 – 69 | 13 | 16 | 8 |

| 1 – 50 | 30 – 39 | 13 | 16 | 12 |

| 1 – 50 | <30 | 13 | 16 | 14 |

| 51 – 54 | 16 | 19 | 15 | |

| 55 – 59 | 16 | 19 | 16 | |

| 60 – 64 | 16 | 19 | 17 | |

| 65 – 69 | 16 | 19 | 18 | |

| 70 – 74 | 16 | 19 | 19 | |

| 75 – 79 | 19 | 22 | 20 | |

| 80 – 84 | 19 | 22 | 21 | |

| 85 – 89 | 19 | 22 | 22 | |

| 90 – 94 | 19 | 22 | 23 | |

| 95 – 99 | 20 | 23 | 24 | |

| 100 – 104 | 21 | 24 | 25 | |

| 105 – 109 | 22 | 25 | 26 | |

| 110 – 114 | 23 | 26 | 27 | |

| 115 – 119 | 24 | 27 | 28 | |

| 120 – 124 | 25 | 28 | 29 | |

| 125 – 129 | 26 | 29 | 30 | |

| 130 – 134 | 27 | 30 | 31 | |

| 135 – 139 | 28 | 31 | 32 | |

| 140 – 144 | 29 | 32 | 33 | |

| 145 – 149 | 30 | 33 | 34 | |

| 150 – 154 | 31 | 34 | 35 | |

| 155 – 159 | 32 | 35 | 36 | |

| 160 – 164 | 33 | 36 | 37 | |

| 165 – 169 | 34 | 37 | 37 | |

| 170 – 174 | 35 | 37 | 37 | |

| 175 – 179 | 36 | 37 | 37 | |

| 180 – 184 | 37 | 37 | 37 | |

| 185 – 189 | 37 | 37 | 37 | |

| 190 or over | 37 | 37 | 37 |

Diesel supplements: * add 4% subject to a maximum charge of 37%. For diesels that conform to RDE2 testing the 4% surcharge does not apply.

Changes in company car tax that you should know about

- Ultra low emission cars have 10 bands from 2020/21: The bandings depend on the amount of CO2 emissions produced and how far the car can travel in pure electric mode. An ultra low emission car is a vehicle with emissions below 75g/km

- Diesels are subject to a 4% surcharge from April 2018

- Diesel hybrids are not subject to the 4% diesel surcharge that applies only to cars that run solely on diesel

Company car tax bands 2020/21

- Click here to find out how the company car tax tables favour ultra low emission vehicles (ULEVs) in 2020/21

What if my company car doesn’t have a CO2 figure?

You need to apply the following company car tax table which is based on engine size

- 0-1400cc: 15% (petrol, gas and conversions); 18% diesel

- 1401-2000cc: 25% (petrol, gas and conversions); 28% diesel

- Over 2000cc: 35% (petrol, gas and conversions); 35% diesel