There are five principal ways your business can fund its company cars. Let’s start with less cash intensive business car leasing options.

To access a handy printable PDF version of this factsheet, simply complete your details below

Why should you read this?

- You need to run cars on the business for your staff

- You need to know what your company car finance options are and how they work

- You don’t know whether to buy or to lease

Business car leasing

Commonly called ‘contract hire’ in the trade’s jargon, this is just like using a short term rental car but over a longer period.

The only difference is that you have to insure it yourself. Otherwise all other items, except fuel of course, are covered.

Plus points: Lower monthly payments than HP; wide variety of vehicles at large fleet discounts; no resale issues – you hand the vehicle back at the end of the term. Maintenance, depreciation, road tax, funding and vehicle administration are all included plus the options of additional breakdown cover and replacement vehicles. Off balance sheet funding for non-quoted companies.

contract hire is highly tax and VAT efficient

Contract hire is also available without a maintenance package (non-maintained). Highly tax and VAT-efficient.

Minus points: Fixed length contract may not be suitable; you never own the car; watch out for end of lease fair wear and tear small print to avoid unexpected charges.

Finance leasing

You pay a low monthly rental with a large final payment, known as a balloon payment.

This is set at the beginning of the contract and is what the leasing company expects the car will sell for at the contract end.

If it is sold for more you will receive some of the ‘profit’ – if less, then you’ll have to pay up.

A finance lease can be ‘fully amortised’, ie with no balloon payment. The results is higher rentals but the sales proceeds, less an administration fee, are returned to you.

Plus points: Fixed rentals; administration (road tax, etc) can be included; flexible funding options can tailor repayments to suit your company’s cash flow; part of the rental can be set against tax.

Minus points: Risks in maintenance and residual value; fixed length contract may not be suitable; may need additional finance to fund the ‘balloon’; on balance sheet funding.

Outright purchase

Outright purchase can be undertaken from your own funds, on overdraft, or on a financed loan.

Plus points: you own the vehicle, claim the writing down allowances and decide yourself when you sell it.

Minus Points: you carry maintenance costs and risk in the residual value. The vehicle is on the balance sheet.

You also have to do the administration – renewing the road tax, paying the maintenance bills and ensuring it’s MOT’d when necessary.

And of course, you’re using up funds that might be better employed elsewhere in the business.

The 5 ways

- Contract hire

- Finance lease

- Outright purchase

- Hire purchase

- Contract purchase

Hire purchase

Hire purchase (HP) is a funding option largely out of fashion but nonetheless one that can be useful to companies that wish to own their vehicles but also fund them externally.

HP works if you want to own the cars

You repay the cost of the car on a monthly basis taking ownership during the course of the contract. You have all the responsibilities of ownership just as in outright purchase. You can claim capital allowances plus offset the interest element of finance against tax.

Contract purchase

Next steps

- Get advice from a professional adviser such as an accountant

- Decide on what form of car finance suits you best

- Access finance through car dealers or independent small fleet leasing companies

- Grow your business with the right cars to do the job

This method of funding is essentially a hire purchase agreement with a maintenance package bolted on. All the maintenance is covered, plus administration, but you still run the risk on the residual value. Unlike HP there is usually a balloon payment equal to the car’s residual value at the end of the term.

Like HP the car must be on the balance sheet so capital allowances can be claimed. The finance element can also be offset against tax.

And VAT

Generally if you buy a car you can’t claim any VAT back.

If you lease a car you can reclaim 50% of the VAT on the lease payments unless you can prove that the car is used exclusively for business, in which case you can reclaim 100%.

You can reclaim VAT on repairs provided the business pays for the work, and there is business use of the vehicle.

Fleet Alliance and company car finance

Fleet Alliance is a leading UK fleet management provider offering contract hire, leasing and a complete range of fleet solutions products, from personal contract hire through to small fleet contract hire.

Why are we associated with this factsheet?

Because we’re a market leader in the provision of car finance to the SME market as well as larger corporate fleets.

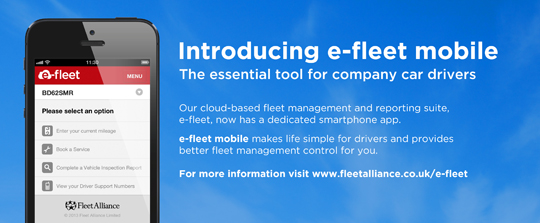

e-fleet

Fleet 360 is delivered via e-fleet, our cloud-based fleet management and reporting system.

Coupled with our strong people-based customer service ethos, e-fleet provides a complete outsourced fleet management solution.

We currently manage over 10,500 vehicles with a combined value in excess of £200m.

We deliver a complete fleet solution via our market leading Fleet 360 model which provides the best combination of advice, products, competitive pricing and outstanding service.

So whether you’re interested in a personal lease or a contract hire, we can find a competitively priced car for you.

You can look us up at our website where you’ll also find industry news, white papers to help you make more informed decisions and, if you’re interested, our blog which takes a light hearted look at serious fleet issues.

While you’re there, why not try out company car tax calculator.

So if you’re looking for finance or fleet advice, call us on 0845 601 8407.