THE UK new car market received welcome news, growing 10.4% in April, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT).

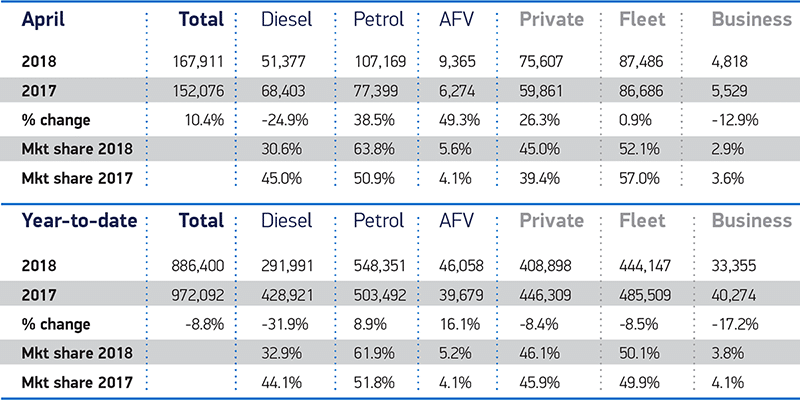

There were 167,911 new cars registered compared with 152,076 in April 2017.

The SMMT said demand was affected by a number of factors:

- the timing of Easter, which meant two additional selling days this April,

- and March’s adverse weather, which pushed some deliveries into April

Most significant, however, were the VED changes that came into force last April, causing a pull forward into March 2017 and a subsequent depressed April market.

April figures show a mixed picture of demand:

- Private registrations grew 26.3%

- The fleet market remained stable at 0.9%

- Business registrations declined, falling -12.9%

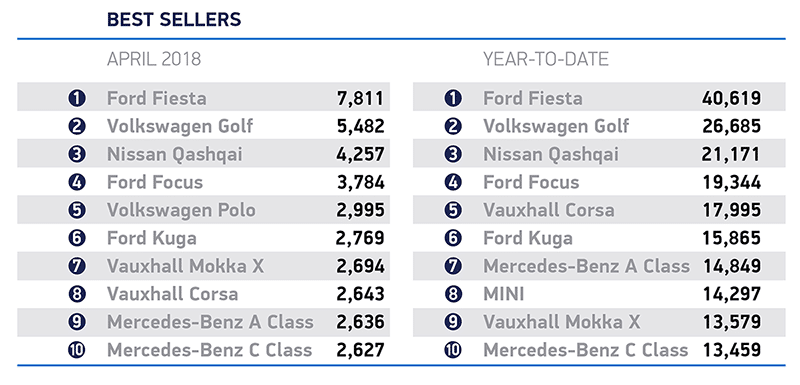

Demand for supermini and dual-purpose cars saw the most significant growth of all segments, up 27.0% and 26.8% respectively.

Diesel continues to drop away

Demand for petrol cars grew in April, up 38.5%, while diesel registrations continued the recent trend, declining -24.9%.

The biggest winner, though, were registrations of plug-in and hybrid electric cars – up 49.3%, thanks to a growing choice of models. However, these AFV vehicles still only account for a minor 5.6% of the market.

Despite the significant rise in the month, the overall new car market remains down year to date, with new registrations in the first four months falling -8.8%, year on year, to 886,400 units. The SMMT said it expected this level of decline to slow over the course of 2018, but political and economic uncertainty would continue to affect the market and further instability could cause additional disruption.

Uncertainty over company car tax makes planning difficult

Uncertainty over company car tax makes planning difficult

Ashley Barnett, Head of Consultancy at Lex Autolease said:

“It’s unsurprising to see new car registrations for April rebound Y-O-Y, given the VED changes in 2017 which saw more deliveries brought forward to March.

“Looking at the year-to-date figures however, the market is down – but this is not necessarily the best indicator of how the new vehicle market is performing.

“The average replacement cycle for most UK company car fleets is four years. If we compare Q1 2018 with the same period in 2014 and 2010, there is in fact a slight increase over time (17% between 2010 and 2018 and 4% increase between 2014 and 2018).

“Of more concern is that in order to meet government targets around emissions, we do need to see a more marked increase in registrations, so that older, more polluting vehicles are replaced with new, cleaner technologies.

“The Budget is now not taking place until the autumn which means the industry does not yet know the Benefit in Kind tax rates for what will be the fourth year of many fleets’ four-year replacement cycle. The lack of this key information makes it harder for fleets and drivers to plan for the future. As a result many consumers and fleets are holding off from placing orders. In some instances, drivers are opting out of new company cars to take older, less environmentally friendly vehicles.”

Customers moving towards cleaner cars

Simon Benson of AA Cars might be of use:

“After 12 consecutive months of decline in new car registrations, it appears that today’s SMMT figures could be the light at the end of the tunnel for the industry.

“It’s likely that some deliveries of new cars will have been pushed into April due to adverse weather through March but this should not dampen spirits over what seem to be positive improvements in the market.

“With an almost 50% increase in registrations for alternatively fuelled vehicles, the SMMT data gives a clear indication that demand for hybrid or pure electric cars is booming.

“The picture we are seeing with our data reinforces that view, with drivers becoming more conscious of how clean cars are before making a purchase.

“It will be interesting to see if the used car market also sees an increase in demand – our own data reinforces the view that consumer confidence in used cars is holding steady and has made up somewhat for the fall in car sales over the last year.”

Mike Hawes, SMMT Chief Executive, summarised:

“It’s important not to look at one month in isolation and, given the major disruption to last April’s market caused by sweeping VED changes, this increase is not unexpected. While the continuing growth in demand for plug-in and hybrid cars is positive news, the market share of these vehicles remains low and will do little to offset damaging declines elsewhere. “Consumers need certainty about future policies towards different fuel types, including diesel, and a compelling package of incentives to deliver long-term confidence in the newest technologies.”

Uncertainty over company car tax makes planning difficult

Uncertainty over company car tax makes planning difficult